Strong focus to preserve financial resilience amid volatile trading conditions

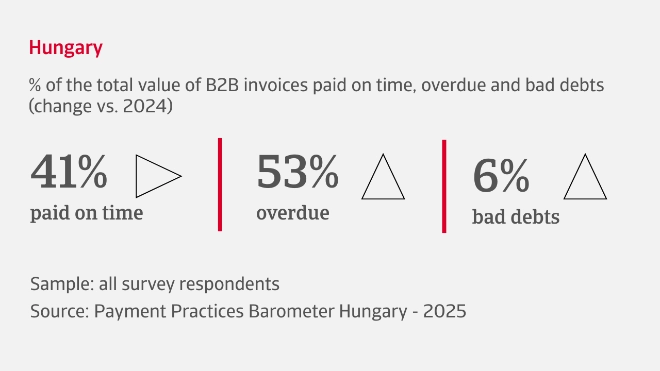

Our survey of companies in Hungary reveals that 41% of business-to-business (B2B) sales are transacted on credit, an approach that has held steady in recent months. The prevailing trend is for companies to maintain their existing trade credit policies, although those making changes are more likely to extend credit than restrict it. This strategy shows how businesses are trying to keep customer relationships strong and sales steady while staying cautious about the rising risk of late payments and defaults. Most companies offer payment terms ranging from 30 to 60 days.

Despite stable Days Sales Outstanding (DSO), the ability to unlock working capital remains limited. Most companies are also dealing with flat or rising inventory levels, signalling tied-up cash in stagnant stock. Days Payables Outstanding (DPO) remains unchanged, as firms aim to respect supplier agreements and avoid jeopardizing supply chain relationships. Where delays occur, they are usually tactical, designed to ease short-term liquidity strain.

Looking ahead

Companies braced for rising insolvencies and pressure on profits

More than half of Hungarian companies expect a rising trend of B2B customer insolvencies in the months ahead. This represents a sharp increase compared to earlier this year, pointing to widespread concern about customer financial health in what is already an unpredictable economic environment. The other 48% of firms are either unsure or do not expect a significant change, highlighting a sense of uncertainty and mixed sentiment across industries.

An increasing number of Hungarian companies are anticipating a surge in B2B customer insolvencies in the coming months. This reflects growing concerns about customer financial stability in an already unpredictable economic climate

Several major concerns are expressed by companies looking to the future. These include ongoing geopolitical tensions that may disrupt trade and supply chains, increasingly complex regulatory requirements, as well as rising environmental pressures which are accelerating a push toward sustainable practices. Overall, Hungarian businesses are entering a period marked by financial vulnerability, especially given the expectation of rising insolvencies, flat working capital indicators and downward pressure on profitability.

Industry insights

Agri-food

Nearly half of businesses in this sector report keeping trade credit offerings steady in recent months, while more have opted to reduce rather than increase credit sales. Currently, only 42% of B2B sales are made on credit, a significant decline, highlighting a shift toward risk containment and tighter liquidity management. Payment terms are steady, typically ranging from 30 to 60 days, reflecting a conservative credit policy aimed at controlling exposure to customer defaults. Overdue payments have dropped considerably, now affecting just 40% of B2B invoices. Bad debts now average 5% of B2B invoices, less than half the rate seen a year ago.

Energy and fuel

Caution is the watchword in the energy and fuel sector, with 46% of firms keeping trade credit policies unchanged, while more have scaled back than extended credit to B2B customers. B2B sales on credit have slipped to 38%, reflecting a shift toward risk containment. Payment terms remain largely unchanged, typically ranging from 30 to 60 days. However, pressure on liquidity is mounting. Overdue payments have surged, now affecting 59% of B2B invoices, while bad debts have risen to 9% of receivables, more than double the level seen a year ago, undermining profitability and straining cash flow.

Transport

46% of B2B sales are transacted on credit in the transport sector, while companies are split between keeping credit terms steady and extending them. This reflects a cautious effort to support customers while managing cash flow risks in an increasingly unpredictable environment. Payment terms also vary significantly, with companies nearly evenly split between maintaining, shortening, or lengthening terms. Most terms still fall within the 30 to 60-day range. Overdue invoices have surged, now affecting 59% of B2B transactions. This rise is chiefly attributed to customer liquidity struggles, which also contribute to an increase in bad debts, now averaging 4% of invoices.

Interested in finding out more?

For a complete overview of the 2025 survey results for Hungary, download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- Over half of the companies in Hungary have not seen a shift in B2B customer payment behaviour. However, for those who have, the trend is negative

- Businesses are increasingly focusing on strengthening their financial stability to cope with unpredictable market conditions

- The profitability outlook is pessimistic, with many companies across various industries preparing for a decline

- Looking ahead, ongoing geopolitical tensions, complex regulatory requirements, and rising environmental pressures are major concerns for Hungarian businesses