Solid performance, but high input prices could become an issue

In the Netherlands, ICT market performance has been very sound during the last couple of years, and although growth has slowed down somewhat compared to a peak period at the height of the pandemic, we expect the overall situation to remain positive. IT and information services should benefit from increasing digitalisation, while telecommunication growth is sustained by rollouts of 5G networks.

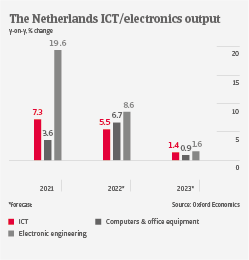

Chip supply shortages may improve slightly in H2 of 2022, but backlogs will remain an issue into 2023. The chip shortage should boost production of electronic components, but at the expense of output in key chip-consuming segments. While we expect ICT output to grow 5.5% this year, it will slow down to 1.4% next year.

Currently, most businesses in chip-consuming segments (such as computers, telecommunications equipment, consumer electronics) are still able to pass on higher costs for semiconductors to end-customers. However, less predictability of product lead times could make it more difficult for ICT companies to manage prices for their products in the coming months. Deterioration of consumer sentiment due to persisting high inflation remains a downside risk for sales of consumer electronics and computers. It remains to be seen if producers in both segments can pass on higher input prices in the coming months, or if margins will come under more pressure.

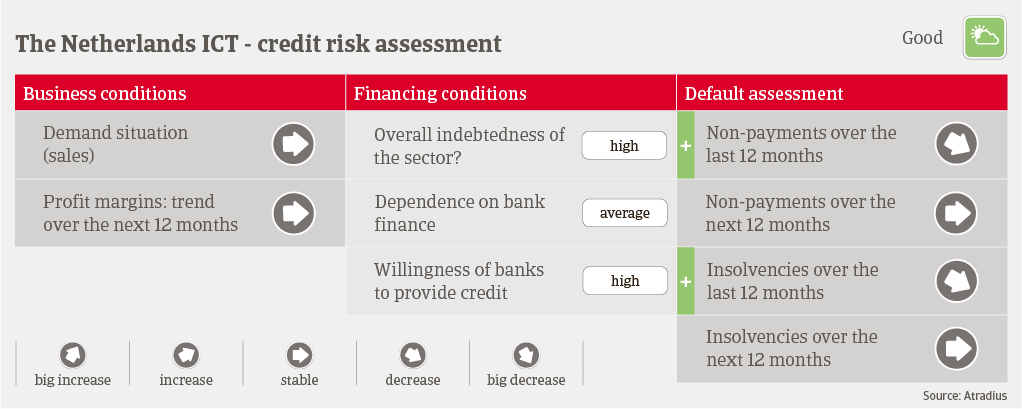

Ongoing consolidation and acquisitions in the sector have resulted in higher gearing of affected ICT businesses, particularly when private equity is involved. To a large extent ICT companies depend on creditors and prepayments for their financing. Overall, the financing conditions are favourable compared to other industries, because the loan policy of banks towards ICT is open. Payments in the Dutch ICT sector take 30 days on average, and payment behavior in the industry has been good during the past two years. The number of ICT payment delays and insolvencies has been low in 2021 and H1 of 2022, and we expect no deterioration in the coming twelve months. Given the stable business performance and credit risk situation, our underwriting stance is open for all ICT subsectors, even very open for the electric component producers, telecommunications, and ICT wholesalers and retail segments.

Documenten

986KB PDF